Moody’s affirmed the company’s “B3” rating but signalled the potential wide-reaching impact of the pandemic across wealth management.

How does an advisor ask clients to transfer accounts at a time when many people are afraid to simply leave their house?

As financial hardships mount with the COVID-19 outbreak, Fannie Mae and Freddie Mac released their plans for mortgage borrowers impacted by the pandemic.

If the Federal government doesn't help, the $12 billion plan could be funded by the city selling "relief bonds."

A number of proposals have been floated for debt payment holidays and other types of moratoria, but such approaches offer solutions that are worse than the problems.

Officials and employees are working from home and doing inspections of U.S. audit firms remotely to protect them from infection.

Southern California's 2020 housing market got off to a good start before the pandemic shook the economy in mid-February, CoreLogic figures show, with both prices and home sales up in the six-county region from February 2019 levels.

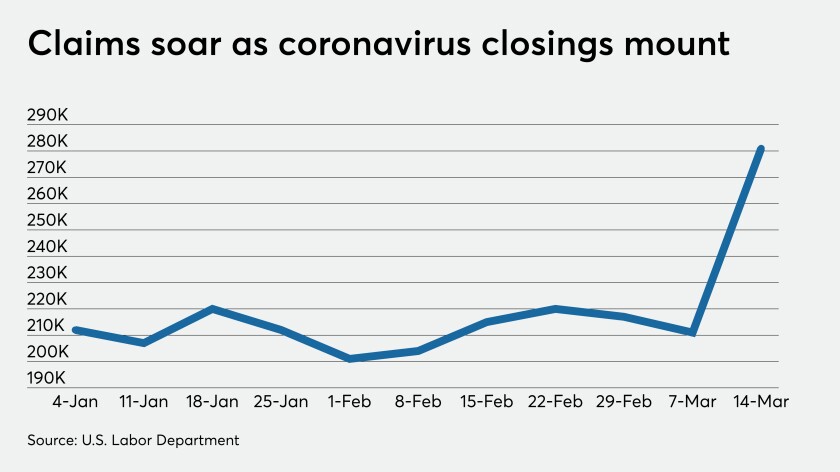

As the Federal Reserve continues trying to keep markets liquid as the stock market sinks, economic data are showing the effects of COVID-19.

BDA told Fed Chair Jerome Powell that two existing programs could help the muni market overcome the impact of the virus.

NASBA and the AICPA announced the decision after test administrator Prometric closed its test centers across the United States and Canada for 30 days.