Homebuilder sentiment fell to a four-month low in March as expectations of future sales dimmed amid a virus outbreak that threatens to dent activity across the industry and cause a recession.

There are several forbearance measures the agencies can take now to keep banks from failing in a downturn triggered by the coronavirus.

“This is a demand and supply shock,” Jay Clayton said, adding that he’s concerned businesses might not have access to all the credit they need.

Financial institutions’ legislative agenda was already a low priority in Congress. Lawmakers’ efforts to stabilize the economy have shifted attention even farther away from bills that would benefit the industry.

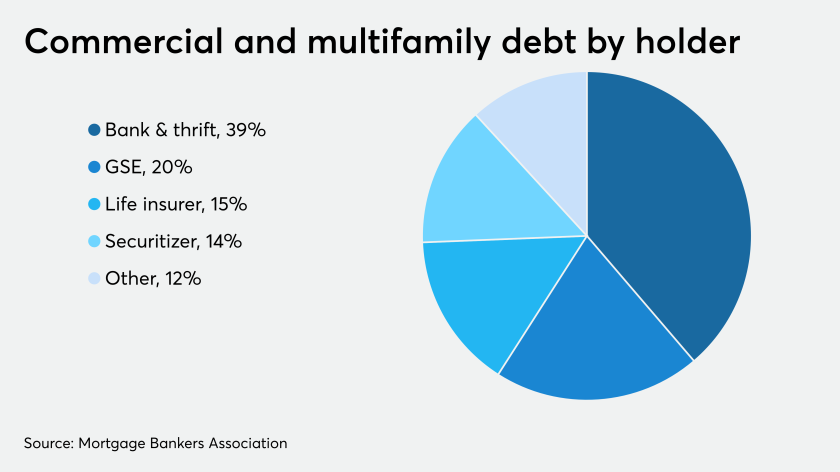

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

More than half of chief financial officers see the potential for a significant impact on their business operations, according to a new survey from PwC.

The National Credit Union Administration also ordered its own employees to work from home until at least the end of March.

The Federal Reserve's most recent economic-stimulus effort could reduce disparities between a rally in Treasurys and a relative slump in mortgage-backed securities that contributed to higher average home-lending rates last week.

The municipal finance industry is dealing with minute-by-minute news of state-wide school closures, shuttered restaurants, curfews and canceled events. New issues are increasingly being put on the day-to-day calendar.