A complete disconnect between liquidity providers and seekers exposed the market’s inefficiencies: an asset class dominated by a limited investor base—retail investors—has grown increasingly concentrated.

How FAs and firms are adapting to a radically different business environment.

Proponents make them a standing core equity holding, but not all advisors are sold. One calls them "marketing schemes."

Seeing the size and variation in average returns among a variety of asset classes offers perspective for those who are anxious.

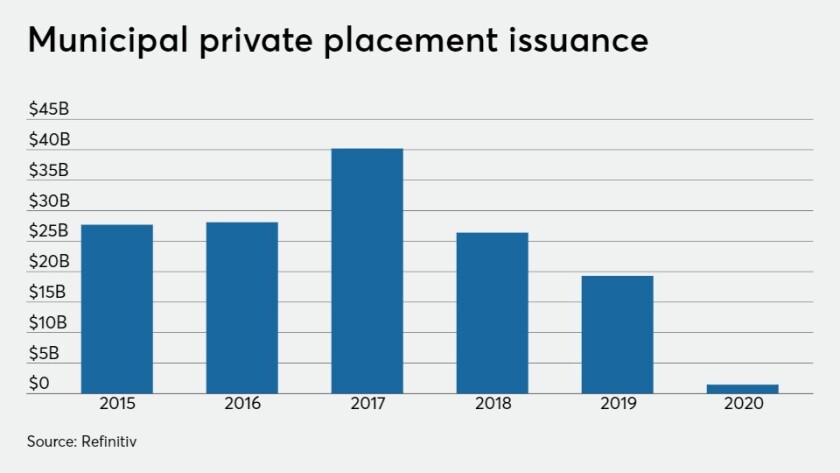

A big New York State Empire Development Corp. private placement is likely to be followed by more until the municipal primary starts functioning again.

Lipper reported a whopping $12.2 billion of outflows from municipal bond funds. Out of that huge number, $5.3 billion were from high-yield funds. The $12 billion figure of outflows in one week equates to about 3% of annual municipal volume.

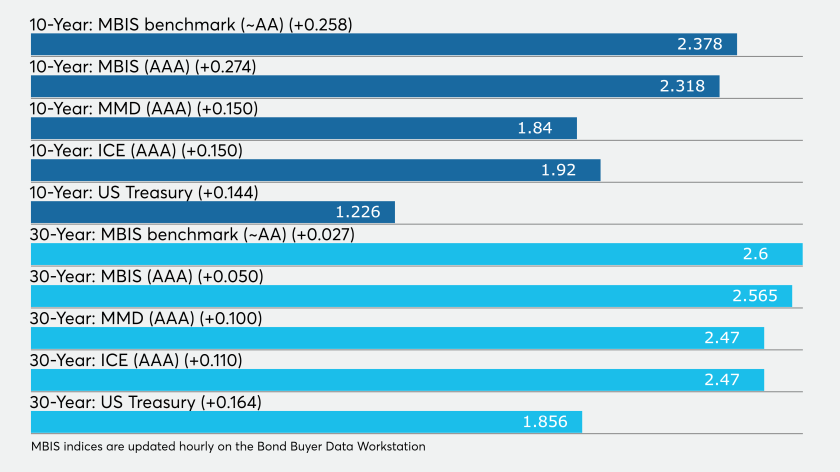

Benchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

An imagined conversation with the legendary Vanguard founder about the coronavirus market crash.

The municipal market is dealing with a major liquidity event, with massive short-end selling.

“This is a demand and supply shock,” Jay Clayton said, adding that he’s concerned businesses might not have access to all the credit they need.