- 2 Min Read

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

2 Min ReadSen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

3 Min ReadThe richer they are, the more options clients have to insulate themselves from the coronavirus and its effects.

5 Min ReadThe markets continue to sink on virus fears, as even a 50 basis point rate cut by the Federal Reserve last week didn’t turn the markets around. The Fed meets again next week and many see more easing, but will those efforts prevent recession?

2 Min ReadThe agencies recommend steps banks should take to proactively prevent disruption of operations, minimize contact between staff and customers, and plan for how affected employees reenter the workplace, among other things.

5 Min ReadStrong data and reassuring words from a Fed official couldn’t stop market virus fears from spreading.

3 Min ReadEven as concern over the rapid spread of the novel coronavirus mounts, the most recent data on area home sales from the Northwest Multiple Listing Service shows the market for Seattle-area residential realty remains hot.

1 Min ReadMarc Odo, client portfolio manager at Swan Global Investments, discusses the Federal Reserve’s emergency rate cut, why more easing may not help, the rocky road ahead, and why consumer confidence will be the key indicator to watch. Gary Siegel hosts.

1 Min ReadThe banking regulators have announced that they are postponing next week’s National Interagency Community Reinvestment Conference because of growing health concerns about the virus outbreak.

2 Min ReadMortgage rates hit their lowest point since Freddie Mac began tracking this data in 1971, as the 10-year Treasury yield fell below 1% after the Federal Open Market Committee's surprise short-term rate cut.

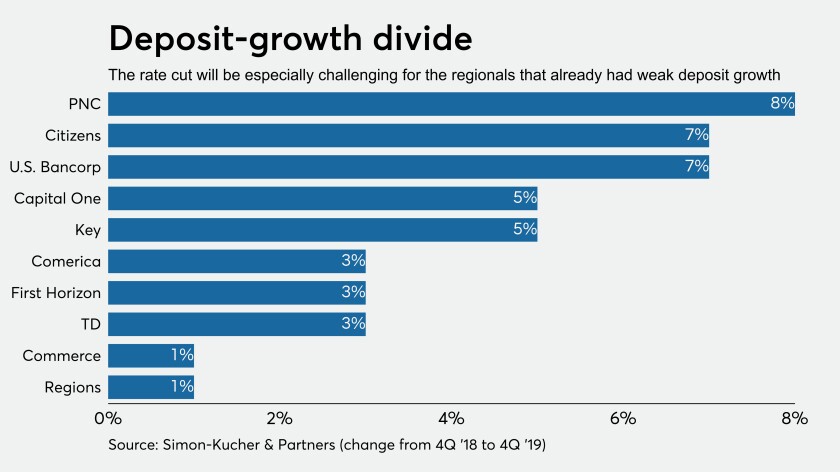

5 Min ReadThe Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

4 Min ReadIn announcing the central bank’s emergency rate cut, Chairman Jerome Powell warned that the Fed can only do so much.

2 Min ReadThe world’s pile of negative-yielding debt has grown as the economic backdrop soured and fears of a pandemic mounted.

1 Min ReadThe Federal Reserve has voted unanimously to cut the interest rate 50 basis points to 1.10% effective March 4, in the first emergency rate cut since 2008.

3 Min ReadThe Federal Open Market Committee cut the fed funds rate target 50 basis points to a range between 1% and 1.25%, it announced Tuesday.

6 Min ReadPolicymakers could recommend banks establish backup facilities and the Federal Reserve could stand ready with emergency loans to limit economic shock waves.

4 Min ReadPolicymakers may not wait until their mid-month meeting and could act with other central banks.

2 Min ReadThe bloodbath in risk assets has intensified on deepening concerns about the economic fallout from the spread of the coronavirus.

1 Min ReadThe Federal Reserve is monitoring the COVID-19 issue and its economic effects, according to a release from the central bank, attributed to Chairman Jerome Powell, released Friday.

3 Min ReadAttention is focused on the impact COVID-19 may have on economic growth in the United States in the short and long term.