- 5 Min Read

A number of proposals have been floated for debt payment holidays and other types of moratoria, but such approaches offer solutions that are worse than the problems.

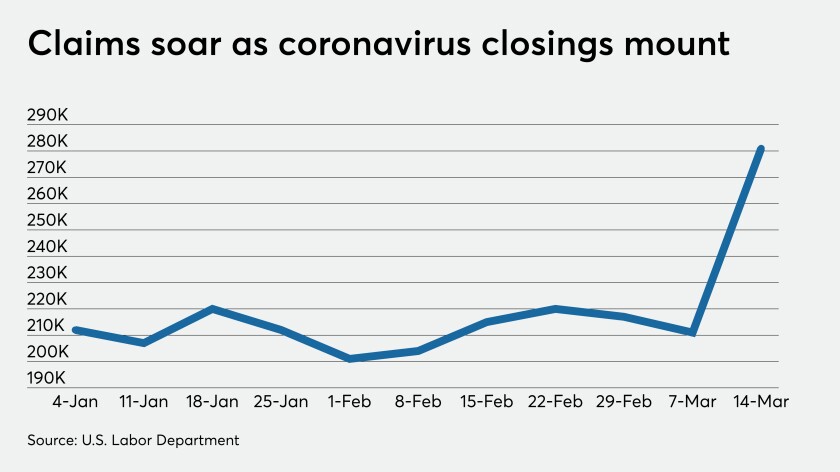

3 Min ReadAs the Federal Reserve continues trying to keep markets liquid as the stock market sinks, economic data are showing the effects of COVID-19.

3 Min ReadBDA told Fed Chair Jerome Powell that two existing programs could help the muni market overcome the impact of the virus.

3 Min ReadThe Money Market Mutual Fund Liquidity Facility, established under the central bank’s emergency authority, echoes a version that was set up during the global financial crisis.

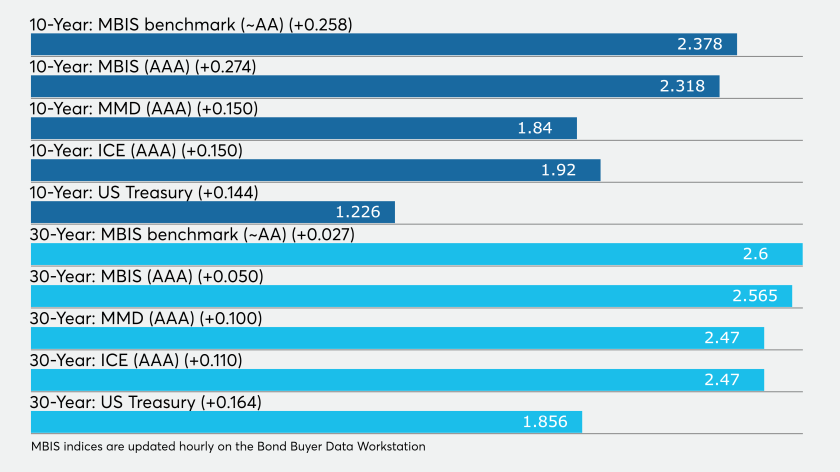

7 Min ReadBenchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

7 Min ReadWith a significant decline in new infections in China, positive news may be ahead, one expert says.

7 Min ReadThe municipal market is dealing with a major liquidity event, with massive short-end selling.

6 Min ReadThe Federal Reserve's support for the commercial paper market made clear that it was willing to go beyond cutting interest rates, but the central bank may feel pressure to do even more as the crisis worsens.

2 Min ReadRegulators issued a rule that gives banks the OK to dip into capital to help households and businesses cope with the economic impact of the coronavirus.

1 Min ReadMortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

2 Min ReadThe central bank said it was establishing the Commercial Paper Funding Facility to "support the flow of credit to households and businesses."

4 Min ReadThere are several forbearance measures the agencies can take now to keep banks from failing in a downturn triggered by the coronavirus.

1 Min ReadThe Federal Reserve's most recent economic-stimulus effort could reduce disparities between a rally in Treasurys and a relative slump in mortgage-backed securities that contributed to higher average home-lending rates last week.

11 Min ReadThe municipal finance industry is dealing with minute-by-minute news of state-wide school closures, shuttered restaurants, curfews and canceled events. New issues are increasingly being put on the day-to-day calendar.

4 Min ReadThe agencies were up and running Monday but have taken steps to allow employees to work from home.

5 Min ReadBankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.

4 Min ReadThe Federal Open Market Committee lowered the fed funds rate target to between zero and ¼% in an emergency meeting on Sunday, but while analysts say the move was needed, they feel it will take more to offset the effects of COVID-19.

4 Min ReadThe actions include cutting the federal funds rate to between 0% and 0.25% and other steps to ease economic stress from the spread of the coronavirus.

2 Min ReadThe central bank is trying to get ahead of possible funding disruptions caused by the coronavirus. Policymakers want to avert a repeat of September, when short-term borrowing costs spiked amid imbalances in supply and demand for cash.

5 Min ReadThere may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.