- 5 Min Read

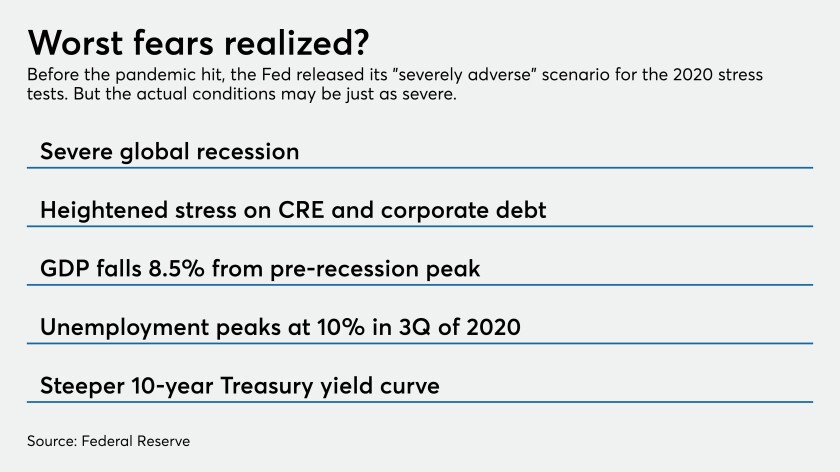

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

1 Min ReadThe $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

1 Min ReadRegulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

4 Min ReadMany borrowers will suffer unless the program, the central bank's latest response to the coronavirus pandemic, includes consumer loans issued by fintechs.

2 Min ReadThe joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

3 Min ReadDetroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

4 Min ReadBanks and credit unions should make it their top priority to pair with the central bank in distributing financial relief to small businesses, even if that means putting everything else on hold.

1 Min ReadThe central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

3 Min ReadPublic finance advocates said the Senate bill has been broadened to authorize the Federal Reserve to purchase all types of bonds that are sold on the secondary market.

4 Min ReadThe short-term funding for airports and transit agencies in stimulus bills won’t be a substitute for the stability of long term financing.

3 Min ReadThe rush to unload mortgage-backed securities signals that a credit meltdown that began with corporate bonds is spreading to other corners of the market.

2 Min ReadAs lawmakers scramble to enact coronavirus relief legislation, some industry groups have suggested Americans could be in for “one of the greatest economic disruptions since the Great Depression.”

4 Min ReadSenate Democrats voted as a bloc Sunday evening to stop consideration of an estimated $1.6 trillion relief package because of its perceived shortcomings, including the lack of provisions to assist state and local governments.

2 Min ReadThe Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

1 Min ReadAccommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," the regulators said.

4 Min ReadThe Fed allowing use of munis as collateral in its MMLF program won't fix all the problems caused by COVID-19 and may add issues.

4 Min ReadSome market professionals were quick to say that the step would not be sufficient to soften the blows hammering the wider muni market.

1 Min ReadThe central bank said its program to support money market mutual funds will also serve as a backstop for state and local governments.

3 Min ReadThe Fed must set up a "family financial facility" that sends billions to households and small businesses so banks don’t misdirect relief funds.

8 Min ReadLipper reported a whopping $12.2 billion of outflows from municipal bond funds. Out of that huge number, $5.3 billion were from high-yield funds. The $12 billion figure of outflows in one week equates to about 3% of annual municipal volume.