The “new normal” of COVID-19-influenced retail is actively being exploited by fraudsters, as LexisNexis Risk Solutions finds fraud costs for U.S. retailers rising in 2020 by 7.3% over last year’s data.

For every single dollar of fraud lost through theft, U.S. retailers pay an additional $3.36, up from $3.13 in 2019, according to a calculation LexisNexis calls its Fraud Multiplier. The components include items such as the fees, interest, merchandise replacement and redistribution per dollar of fraud for which the merchant is held liable.

“A big factor in driving up costs is that 2020 is a very different year due to COVID’s impact,” said Kimberly Sutherland, vice president of fraud and identity strategy at LexisNexis. “The cost of fraud continues to grow despite the virus. The shift in consumer shopping patterns has created a new opportunity for fraudsters as retailers get more desperate to capture sales. The last thing they want to do is turn down legitimate sales that get flagged due to a false positive risk signal.”

LexisNexis found that the average volume of monthly fraud attempts against U.S. retailers increased by over 9% compared to 2019, and the average number of successful fraudulent attacks was also up year-over-year — almost 29% for overall retail merchants. The success rate of fraud attempts in 2020 reached 48% for overall retail, compared with roughly 40% in 2019.

The biggest changes in successful attempts occurred at larger U.S. retailers. There was a 48% increase in successful fraud attempts made against midsize and large retailers that sold digital goods, and a 43% increase in successful attempts made against midsize and large retailers that sold only physical goods.

“Something we’ve seen is that the work-from-home situation has brought on a whole host of new or different devices to the online shopping environment,” Sutherland said. “Someone who may have shopped at work using their desktop is now shopping at home using a laptop or home computer. This makes detecting fraud much more difficult for retailers, as now an account has multiple new devices attached to it, which can cause a false positive. It’s something the fraudsters know is an issue and it’s something they are exploiting.”

Employee Benefit News' March/April issue explores how workplaces are navigating pandemic challenges and making plans to return to the office.

The Internal Revenue Service released information on how employees now have until the end of the year to repay any payroll taxes they deferred from last year.

CPA firms will be in a great position to help their small business clients with the latest round of the Paycheck Protection Program, according to Barry Melancon.

The study specifically saw a spike in fraudulent activity relating to lockdowns occurring in many cities and states. Midsize-to-large general merchandise retailers selling physical and digital goods averaged 70% more monthly fraud attempts than retailers surveyed prior to the national emergency was declared in the U.S. in March 2020.

LexisNexis also found that Canadian retailers, surveyed for the first time in the study, had a lower Fraud Multiplier rate — just $2.87. Canadian midsize-to-large e-commerce merchants had the highest level of cost at $3.52, with smaller e-commerce merchants at $2.86.

“Some of our research has revealed that a number of Canadian companies have been more aggressive in adopting leading fraud prevention methods such as multilayer fraud protection, which is a possible reason for their lower cost level,” Sutherland said.

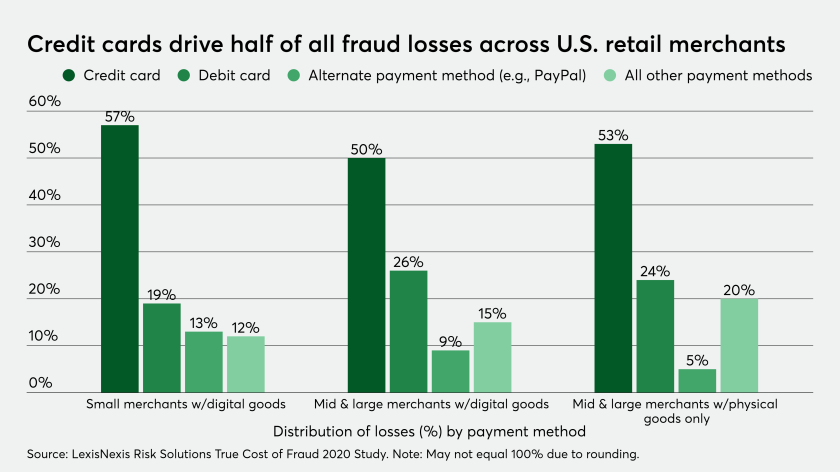

Despite the advances in fraud protection, particularly as it relates to the actual dollars lost to fraudsters, credit cards still account for at least half of all losses experienced by U.S. retail merchants, with debit cards coming in at a distant second place. While credit cards may account for 50% of fraud losses at midsize-to-large retail merchants with digital goods, they account for 65% of losses for midsize-to-large U.S. e-commerce merchants.