Republicans will likely block Democrats’ attempts to have the Senate follow the House in boosting stimulus payments for most Americans to $2,000, even though President Donald Trump backs the bigger checks.

President Donald Trump signed a bill containing $900 billion in pandemic relief, the White House said, triggering the flow of aid to individuals and businesses and averting the risk of a partial government shutdown on Tuesday.

Lawmakers across the political spectrum urged President Donald Trump to sign the $900 billion coronavirus stimulus bill passed with bipartisan support last week, as millions of Americans face a loss in benefits.

House Republicans blocked Democrats’ attempt to meet President Donald Trump’s demand to pay most Americans $2,000 to help weather the coronavirus pandemic.

Tucked in among more than 5,000 pages of legislative text, the congressional bill providing COVID-19 relief and 2021 government funding includes dozens of tax breaks for beneficiaries ranging from downtown restaurants and the film industry to motor-sports racetracks.

The latest round of coronavirus stimulus legislation includes some major tax provisions and changes for accountants to watch out for in the New Year.

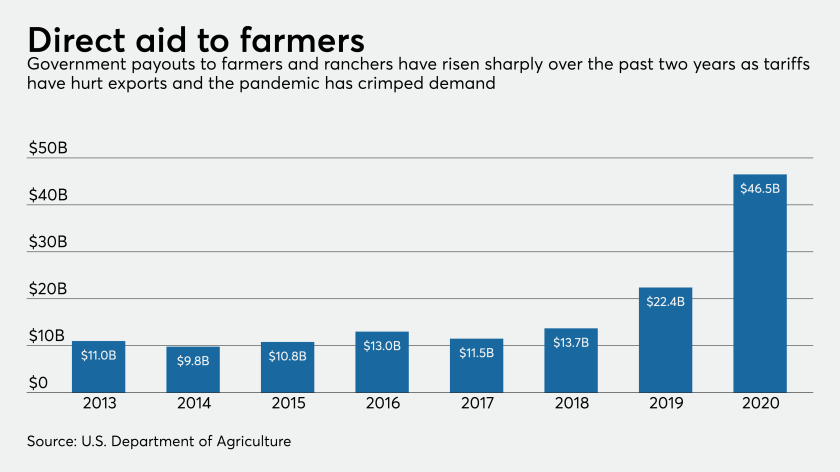

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

The outcomes of two elections in Georgia that are scheduled for Jan. 5 are expected to determine the balance of power in the Senate and may also have an impact on the kind of tax planning that accountants should be advising their clients to do.

Economic experts believe the current surge is not enough to stop continued losses incurred by various segments of economy.

Concerns are increasing over the growing spread of COVID-19 and the preparedness of the incoming administration to deal with vaccine distribution and other critical issues.