The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

The top Republican and Democrat on the Senate Finance Committee said the Treasury Department “missed the mark” in new guidance that limits tax breaks for businesses that get their Paycheck Protection Program loans forgiven.

The guidance clears up the tax treatment of expenses when a loan from the Paycheck Protection Program hasn’t been forgiven by the end of the year.

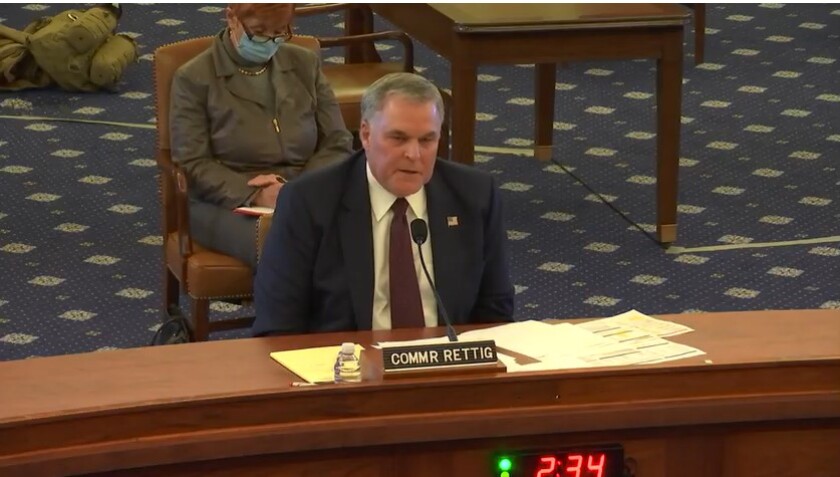

The pandemic is throwing a monkey wrench into plans for the Internal Revenue Service to reorganize itself to provide better taxpayer service.

President Donald Trump spent months on the campaign trail taking credit for “opportunity zones,” a policy meant to encourage investment in distressed communities across the U.S. Joe Biden’s team sees potential in the idea, too.

The president-elect's pledge to repeal President Donald Trump‘s tax cuts as soon as he is inaugurated may be stymied for the foreseeable future.

The IRS is making some changes in its collection program to lessen the burden on taxpayers with outstanding tax debts who are trying to cope with the economic fallout of the COVID-19 pandemic.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

The Internal Revenue Service said Friday it would restart issuing its 500 series of balance-due notices to taxpayers later this month after they were paused on May 9 due to the COVID-19 pandemic.