The leaders of Congress’s main tax-writing committee are wondering if the Internal Revenue Service will be ready to handle next tax season as it’s still processing millions of pieces of correspondence that went unopened for months during the COVID-19 pandemic.

The Internal Revenue Service is reversing course on the automatic revocation notices that it sent to more than 30,000 tax-exempt organizations.

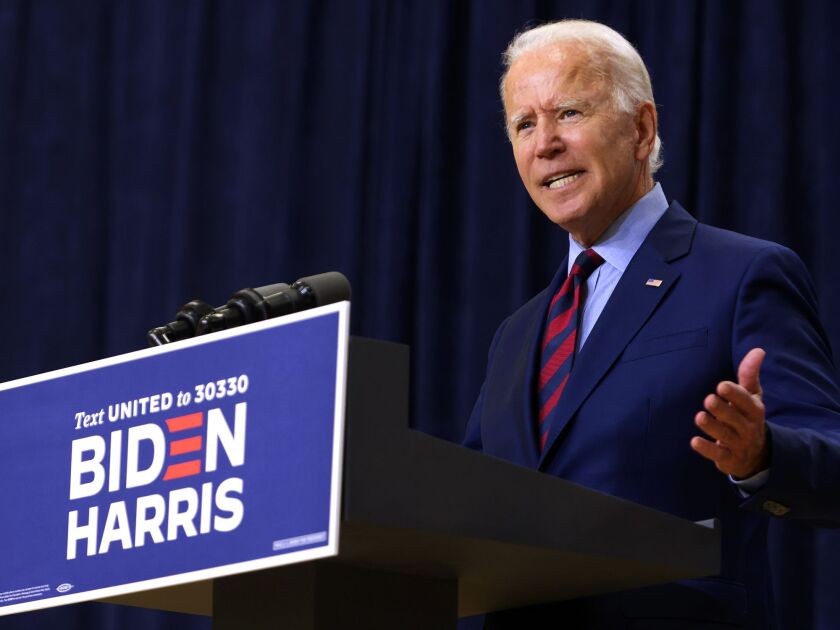

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

This article looks at a few key components of the presidential nominees' tax positions.

The U.S. Small Business Administration and the Treasury Department are making it easier for companies to get their Paycheck Protection Program loans of $50,000 or less forgiven.

Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

Internal Revenue Service commissioner Chuck Rettig heard complaints from lawmakers about their constituents missing stimulus payments.

The Internal Revenue Service issued guidelines Wednesday scaling back a tax break for client entertainment, following through on an element of President Donald Trump’s 2017 tax overhaul that he has said he wants to reverse amid the virus pandemic.

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.