President Donald Trump said he’ll ask Congress to pass more economic stimulus, including a payroll tax cut, even after the government reported a surprise improvement in U.S. unemployment on Friday.

Chairman Patrick Foye said the designation will better position the authority to cope with the revenue loss from the coronavirus pandemic.

The Financial Accounting Standards Board released an accounting standards update providing a one-year effective date delay for private companies and organizations to apply the revenue recognition and leases standards due to COVID-19, although they still have the option to apply the standards early.

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

The funds will be used to support housing, job training and aid for small businesses in communities that have been disproportionately affected by the pandemic.

Senate Majority Leader Mitch McConnell will attempt to expedite approval of changes to the popular Paycheck Protection Program aimed at giving small businesses more flexibility in using the money from the fund, according to Senate aides.

Here are some practice management suggestions for the new normal.

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

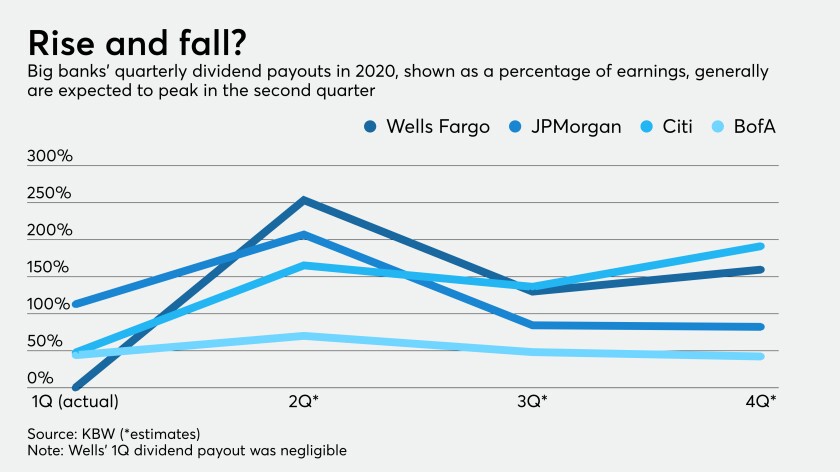

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

In response to the coronavirus, the Internal Revenue Service and the Treasury are giving renewable energy companies more time to develop projects using sources such as wind and geothermal.