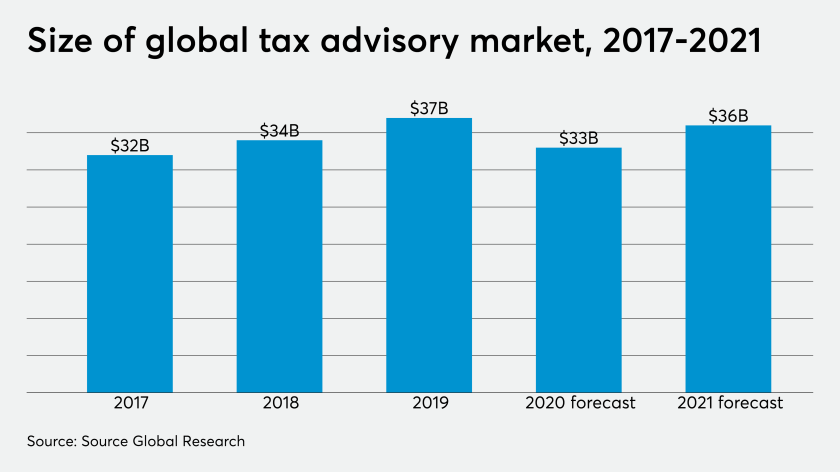

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

The U.S. Small Business Administration and the Treasury Department relaunched the Paycheck Protection Program on Monday to new borrowers, prioritizing loans from community lenders.

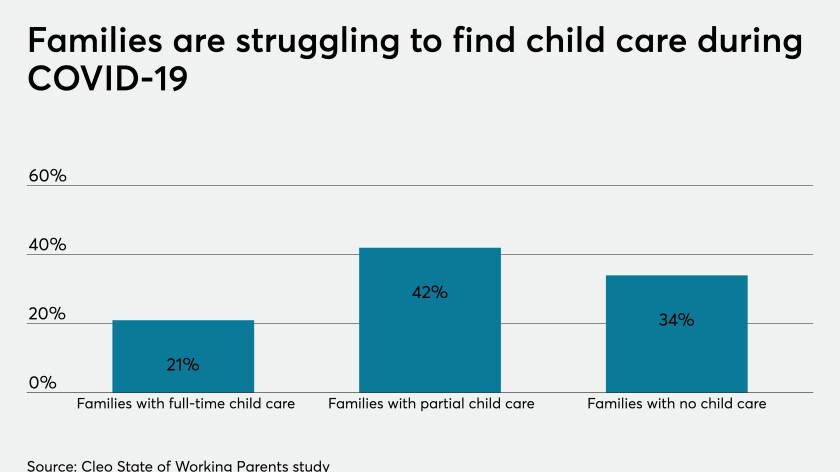

Working parents need more child care solutions in 2021. One benefit company is making on-demand virtual child care an accessible option.

Growth in small business jobs and wages declined last month as a result of the novel coronavirus pandemic, according to payroll giant Paychex.

The economic fallout from the coronavirus pandemic is continuing.

Our Rising Star Awards nomination form is live. And don’t miss these top workplace benefit stories from EBN’s editorial team.

From diversity efforts to greater workplace flexibility, employees have high expectations for what their employer has to offer in the new year.

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

The Internal Revenue Service and the Treasury Department released guidance on claiming deductions for expenses associated with Paycheck Protection Program loans that have been forgiven.

The Internal Revenue Service is once again depositing the latest round of Economic Impact Payments in the wrong bank accounts in a replay of problems experienced last year by many taxpayers.