The document discusses some considerations involving the use of specialists when auditing financial statements during the pandemic.

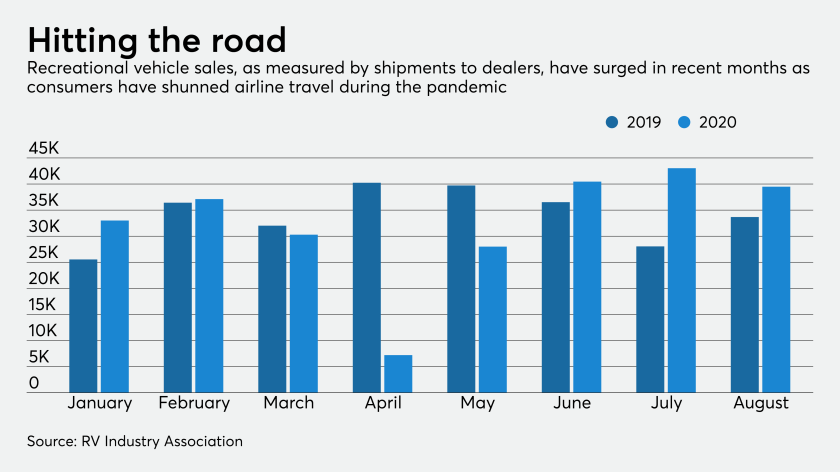

Many consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.

Conversations have already started about how the increased government expenditures to support citizens during the pandemic will be funded. But resisting the urge to increase taxes may be the best way to support economic growth.

Global confidence improved significantly in the third quarter of the year among accountants.

Bank bill-payment sites have become less relevant over the last decade as more people go to billers’ websites to pay directly or use billers' mobile apps — often at the last minute. But the COVID-19 pandemic could flip the script on the $4.6 trillion bill-payment sector.

The board has voted to defer the effective date of its long-duration insurance contract standard for one year.

Corporate boards of directors are dealing with new problems in financial reporting and accounting.

One of the great challenges of working remotely is replicating the interactions and relationships that develop naturally in a physical office.

The Internal Revenue Service issued guidelines Wednesday scaling back a tax break for client entertainment, following through on an element of President Donald Trump’s 2017 tax overhaul that he has said he wants to reverse amid the virus pandemic.

The unemployment rate declined to 7.9 percent in September, the U.S. Bureau of Labor Statistics reported Friday.