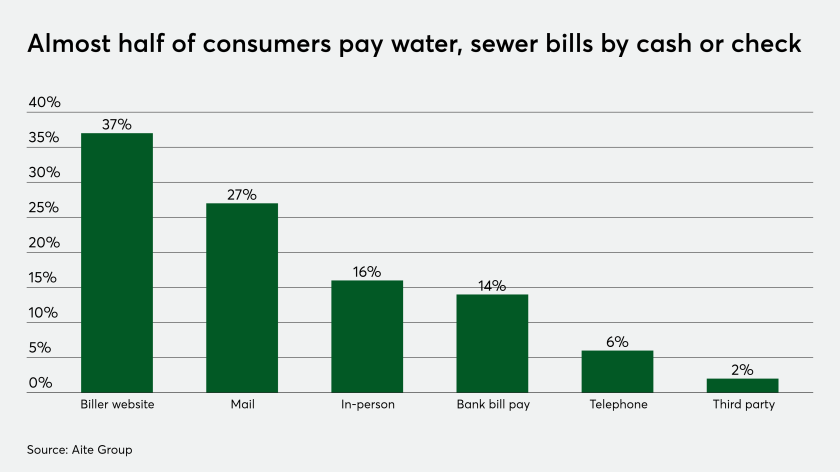

For many U.S. cities and counties, the high number of walk-in payments and checks typically received for services, permits and fees has been aggravating but acceptable — until coronavirus struck.

Under the proposed regulations, amounts paid for DPC arrangements and HCSMs are treated as deductible medical expenses.

A valued accountant is a holistic business advisor to clients, solving human problems that technology simply cannot — and will never be able to — solve on its own.

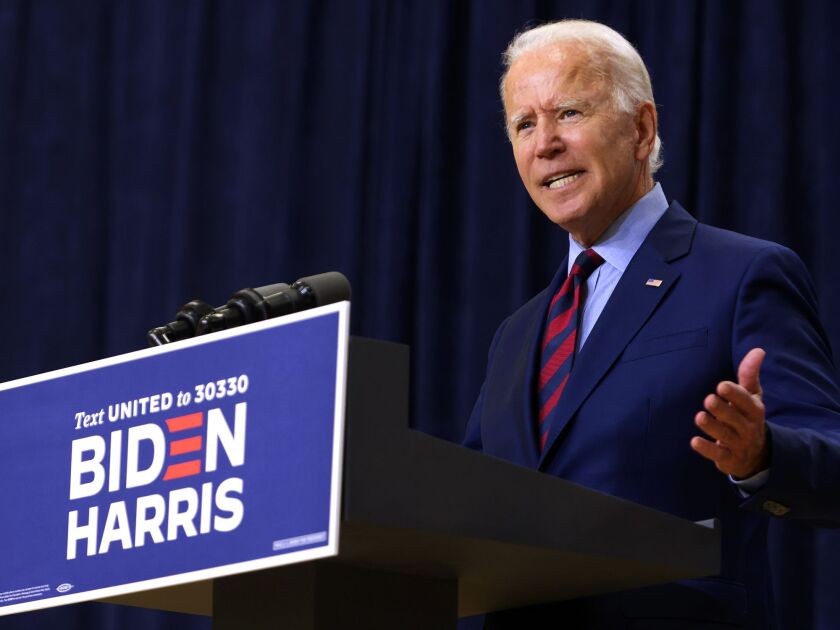

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

Here are seven best practices to boost your website’s efficiency and effectiveness.

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

There are signs of a slowdown in the economic recovery as the COVID-19 pandemic continued to spread.

Small-business employment and hours worked grew a bit in September, especially in the Northeast and within the construction industry, according to the latest monthly report from payroll giant Paychex.

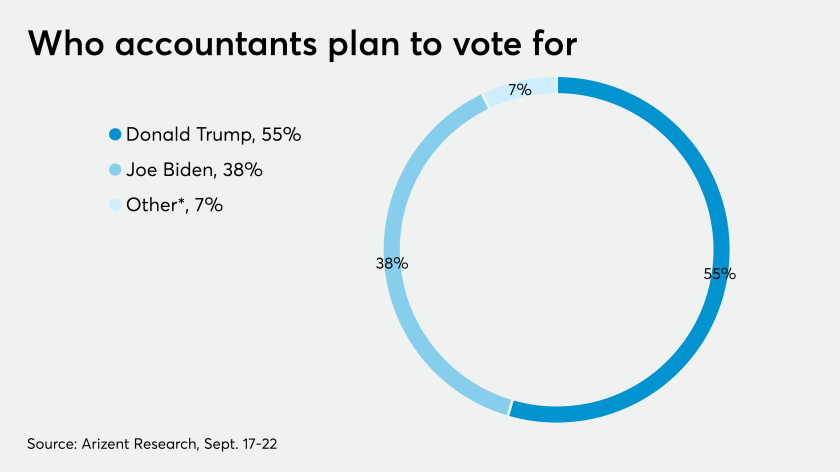

Regardless of their voting intentions, they overwhelmingly expect things to improve after Nov. 3.

Despite the many, many downsides of COVID-19, one of the biggest silver linings has been that it forced CPAs and accountants into being true advisors to their clients.