While they are not dramatically opposed, Jelena McWilliams and Brian Brooks have articulated their own ideas on postal banking and the use of artificial intelligence in lending.

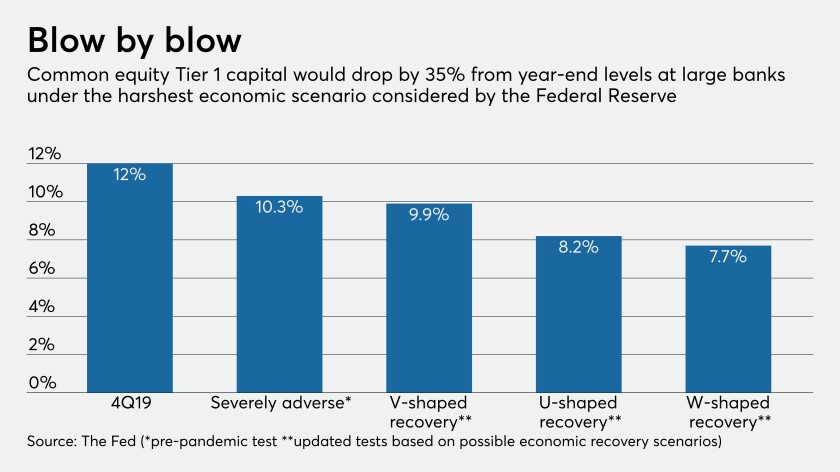

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

Hailee Johnson, a manager in UHY’s audit practice in Michigan, led a softball team sponsored by the firm to a World Series C Softball Championship in 2017, and she is hoping to do the same this year.

Setting partner compensation is an art and not a science. Show me your compensation plan and I’ll tell you your firm’s strategy.

Now perhaps more than ever, banks and their proxies need to show tact when communicating with past-due borrowers.

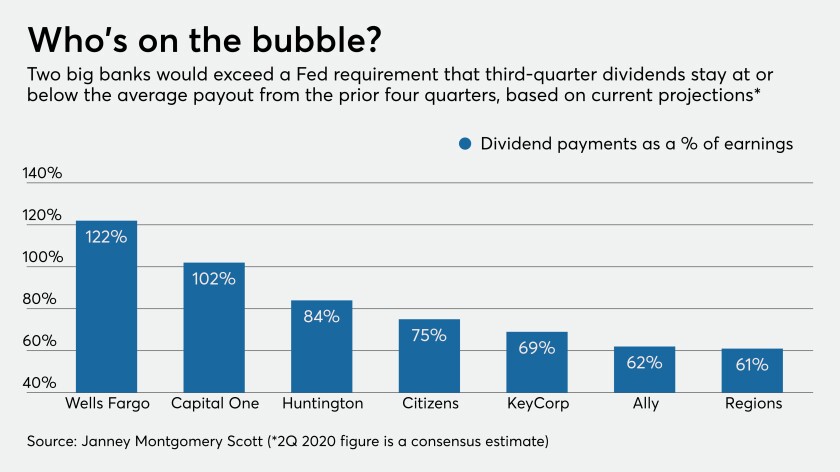

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

The extension also applies to Americans living abroad who would otherwise generally have had a filing deadline of June 15.

The federal government’s quick action to issue stimulus payments led to more than a billion dollars of fraudulent payments, according to the GAO.

Top Democrats in the House and Senate are backing a measure that would deny coronavirus aid to companies that moved their official headquarters offshore to avoid U.S. taxes.

Brick-and-mortar merchants that have shifted to online have changed their risk profile, causing conflicts with the fintechs like Square that handle their payments. And that could be an opportunity for banks.