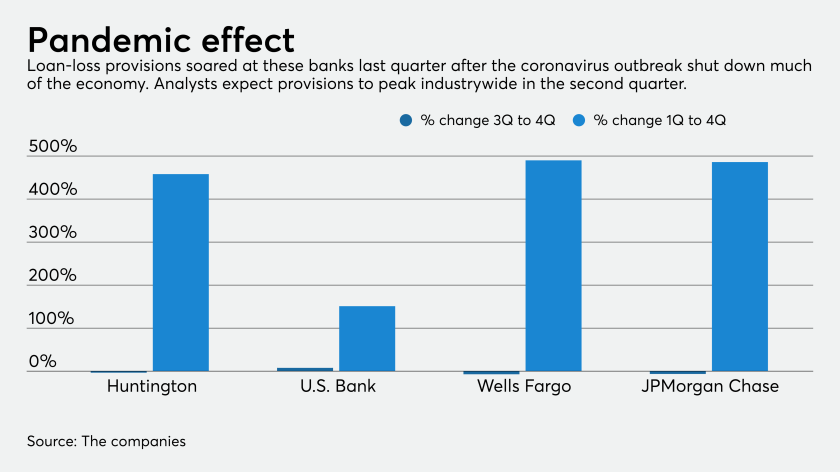

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

The acting head of the agency says it cannot continue relying on web-based exams put in place during the coronavirus and will start sending staff into banks.

The immediate lockdown of the nation’s economy in response to attempts to flatten the coronavirus infection curve has had a widespread impact on the revenues of all businesses, particularly small ones that are more susceptible to economic disruptions.

The institute released guidance on how to account for forgivable loans under the Small Business Administration’s Paycheck Protection Program.

The meeting was the last in chairman Russell Golden’s term.

The ATM industry was already mired in the painful transition away from hardware to digital technology, and now it must try to persuade consumers and merchants that cash isn’t unsafe to handle.

After initially processing the loans manually, the Minnesota bank turned to "low code" software to build the electronic forms and workflows needed to approve loan applications. The result: a more than fivefold increase in the number of loans it could process in a day.

Accountants, as well as lawyers and consultants, who helped small businesses apply for emergency relief funds through the Paycheck Protection Program want to be compensated. Are they entitled to be?

The economic impact of the coronavirus pandemic could lead to the ongoing expansion of workers’ access to early, or earned wages (EWA) through advances and instant payouts, including to new types of users.

A fresh look at the Paycheck Protection Program suggests other ways businesses may want to think about it.