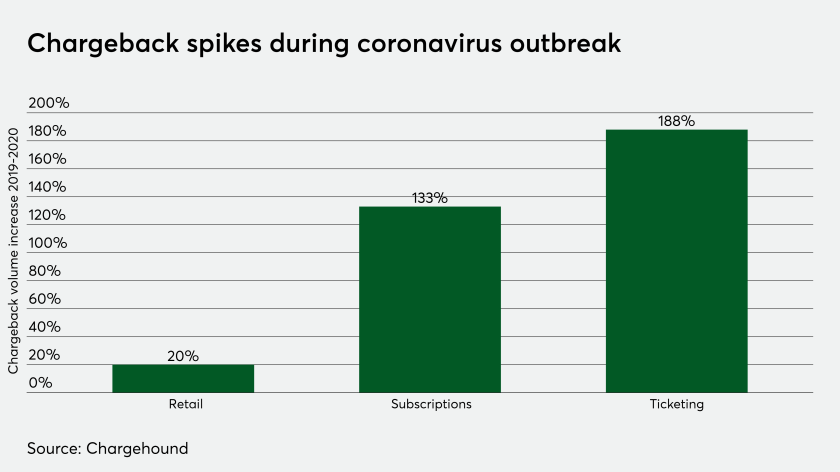

As credit card chargebacks accumulate during the coronavirus crisis from consumers seeking reimbursement for canceled trips and events, PayPal is extending an olive branch to merchants.

In the works for months, Mastercard Track Business Payment Service rolls out Tuesday with the goal of improving efficiency around corporate buyer and supplier payments at a time when these processes are uniquely constrained by the coronavirus pandemic.

Coronavirus has taken a massive toll on suppliers, and emerging invoice methods are getting thrust into the mainstream to rescue cash-strapped businesses.

U.S. card issuers aren’t getting the full benefit of the contactless phenomenon because of their slower contactless card rollout strategies.

When Fiserv purchased First Data in 2019, it was part of an industrywide push to combine bank and merchant technology under one roof. A year later, a key piece of First Data’s technology — and its top executive — have become Fiserv’s path through the coronavirus crisis.

A mix of consumer debt and economic anxiety is shining a light on firms that offer alternatives to revolving credit. This, in turn, creates a chance to further tie financing directly to checkout.

One of the selling points behind multi-account payment cards is the ability to shift spending on the fly or shortly after shopping, such as to fund a recent purchase with loyalty points. During the pandemic, this feature may become a key financial management tool.

When the coronavirus pandemic began, Square pushed hard to get a bigger share of merchants' online sales and consumers' stimulus spending — and even received its long-desired bank license — but found that this wasn't enough to offset the effects of the crisis.

The businesses that are open now are providing clues for payment hardware makers on how the retail landscape will look once the pandemic clears.

Despite PayPal's efforts to get people to receive — and spend — their stimulus checks from PayPal accounts, the coronavirus pandemic caused its revenue for the first quarter to come in below company guidance.