Visa is delaying previously announced interchange and fee changes until April 2021, except for changes in the supermarket category, which will remain on the same schedule.

There is one area of commerce that has experienced an uneven consumer response to the coronavirus crisis: subscriptions. Some companies have benefited greatly while others have not.

With the coronavirus pandemic forcing far more e-commerce transactions — and thus, more spending on cards instead of cash — loyalty and rewards are vital to creating lasting consumer habits.

Consumer remittance behaviors are being forced to change, with senders and recipients moving to mobile wallets, bank accounts, and cards. But many still want cash.

The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

The short-term coronavirus response revealed most merchants will need a more robust option for digital payments — and that’s prompting fresh investment in what was expected to be a slow period.

Visa pulled its financial outlook for the rest of the year, but it already has visibility into permanent changes that result from the coronavirus — such as an aversion to handling cash.

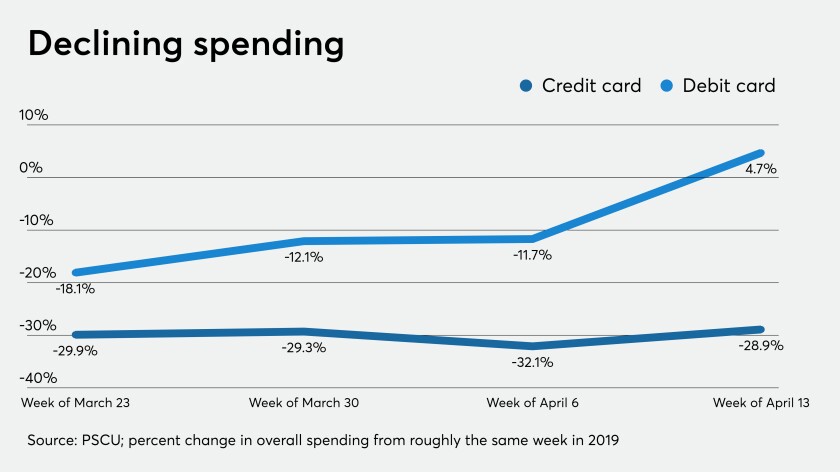

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

There is nothing in U.S. federal laws or general payment processes that stops businesses from taking a consumer's money and using it for payroll or to finance a marketing campaign.