- 4 Min Read

Congress should pass legislation authorizing use of nontraditional data sources to make credit more available to consumers who’ve taken a hit from the coronavirus pandemic.

6 Min ReadAs companies are evaluating continued operations, balancing profits with acceptable levels of loss, functioning with massively more remote work and trying to make up for economic disruptions, the first thought tends to be “How can we cut costs?”

2 Min ReadCrowe has joined the growing number of firms offering solutions to aid in Paycheck Protection Program participation.

4 Min ReadThe $43 billion deal was one of a series of payment mergers in 2019 that were designed to combine bank technology and merchant acquiring across multiple markets and industries while warding off ascendant fintechs offering fast access to digital payments and working capital.

3 Min ReadMany will reconfigure what they do to the new reality and will make some investments in updating and formalizing some of their Band-Aid processes.

6 Min ReadA lack of modern lease accounting capabilities makes it difficult for many businesses with large lease portfolios to regain control, improve liquidity and plan for the future.

2 Min ReadNew digital tools have boosted advisors' ability to reach more — but not all — clients.

3 Min ReadArtificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

4 Min ReadTokenization and buy buttons began, in part, as ways to calm the security concerns of online shoppers who were wary of moving away from plastic. They’re now becoming a way to keep a health and economic crisis from turning into a security problem as in-store checkout quickly gives way to apps and websites.

3 Min ReadAs businesses and employers make the sudden shift to agile working from home, how does this change their approach to maintaining their accounts?

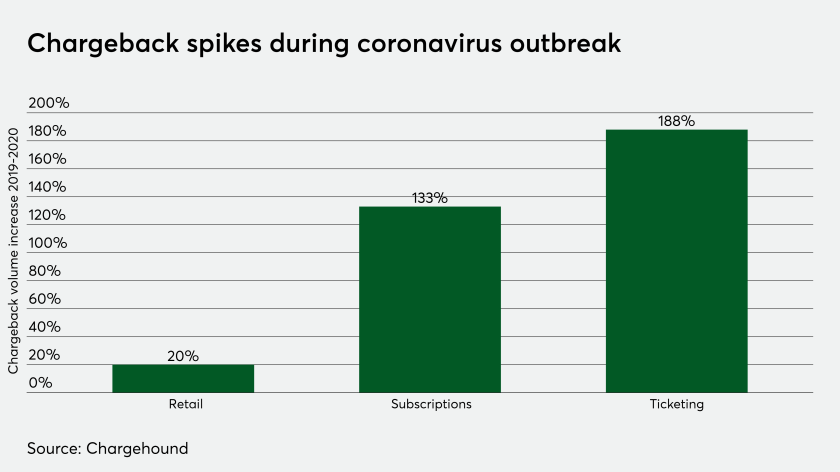

3 Min ReadAs credit card chargebacks accumulate during the coronavirus crisis from consumers seeking reimbursement for canceled trips and events, PayPal is extending an olive branch to merchants.

5 Min ReadU.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

4 Min ReadCoronavirus has taken a massive toll on suppliers, and emerging invoice methods are getting thrust into the mainstream to rescue cash-strapped businesses.

9 Min ReadFinancial institutions are looking for a way to return some employees to their workplaces while prioritizing safety. The answer may involve contact tracing technology and the automation of a wide range of activities.

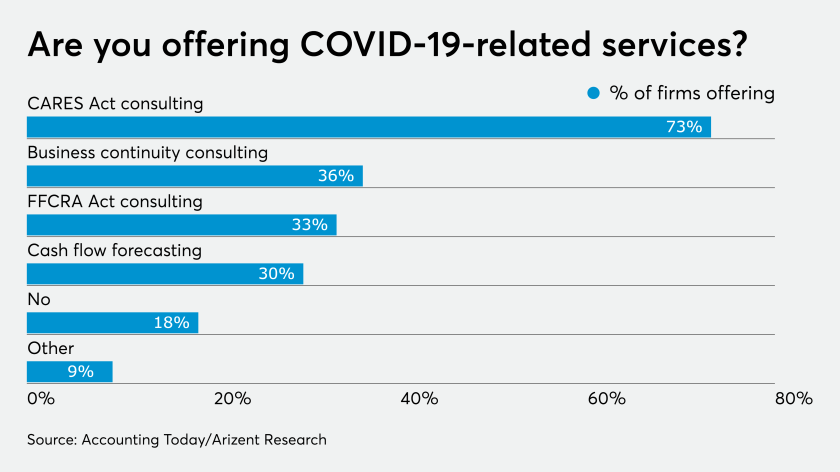

3 Min ReadAccountants should take note of the fact that the current market needs analysts more than historians.

1 Min ReadWithum's Jim Bourke breaks down which of your firm's applications can be swapped to web-based versions right now, and which you'll have to wait for later.

3 Min ReadOne of the selling points behind multi-account payment cards is the ability to shift spending on the fly or shortly after shopping, such as to fund a recent purchase with loyalty points. During the pandemic, this feature may become a key financial management tool.

3 Min ReadThrough its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

8 Min ReadFinancial institutions have been monitoring workers' productivity at home with tracking software and webcams. Now they're mulling whether to mandate contact-tracing apps, COVID-19 testing and other practices that could raise further privacy issues.

1 Min ReadMany of the remote work practices we’re instituting today are likely to be part of a new normal that survives long after the current crisis has ended.