- 1 Min Read

Find more information and the nomination form for Financial Planning's recognition of people, leaders and firms that have demonstrated innovation in response to the coronavirus pandemic.

6 Min ReadIn the shadow of the coronavirus, the AICPA and other groups are working on ways to help the environment.

6 Min ReadFirms that create virtual assistants for financial institutions are training their bots to answer questions about the pandemic and relieve phone lines from a barrage of customer calls.

1 Min ReadThe online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

5 Min ReadJohn Pitts, policy lead for Plaid, has some ideas to ensure Paycheck Protection Program legislation set to be voted on this week targets the companies most in need of a cash infusion.

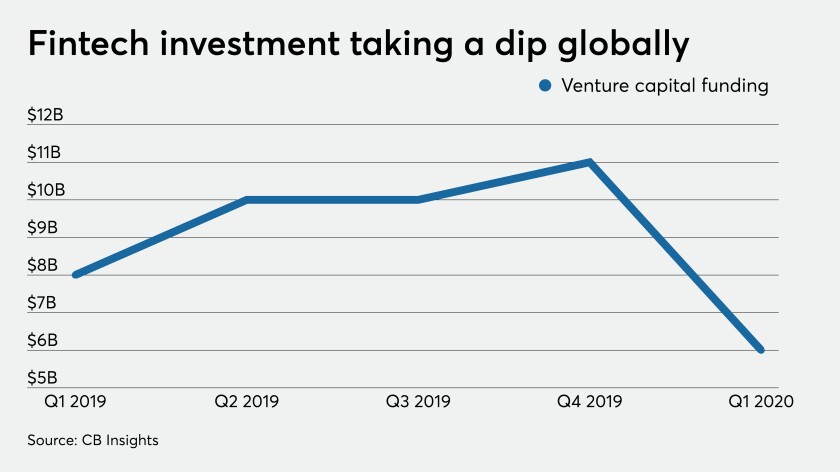

6 Min ReadVenture capital investment has plummeted in many coronavirus-ravaged economies, but larger, profitable fintech firms with the right digital products might still score funding.

5 Min ReadFrom stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.

4 Min ReadFast-moving payments innovation was already threatening comfortable connections between consumers and businesses before the pandemic turned the trend into an outright crisis.

5 Min ReadSquare Capital and other online lenders joined the Paycheck Protection Program just before it ran out of money. Now they’re ready and waiting for Congress to reload funds that could be better aimed at the smallest companies.

3 Min ReadBusinesses need strong predictive analytics to prepare for the way back.

3 Min ReadIT projects are under scrutiny due to the coronavirus, not only in terms of budgets but also how fast firms can deploy automation for tasks such as business payments for companies that have turned to remote work.

5 Min ReadThe Internal Revenue Service is bracing for another epidemic -- scammers trying to get their hands on the $1,200 payments being sent out to millions of Americans to bolster the economy.

4 Min ReadThe SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

6 Min ReadOnline lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

4 Min ReadUnlike in 2008, banks have become a steady force during the coronavirus pandemic.

5 Min ReadAround the same time a sorely needed economic relief package made its way through Congress into law to try to offset the economic wreckage of COVID-19, a unique proposal came to light.

1 Min ReadPayPie is offering access to its network of Small Business Association-authorized lending partners to businesses seeking funds through the SBA Payroll Protection Program during the COVID-19 pandemic and economic slowdown.

5 Min ReadPayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

3 Min ReadCompliance attorneys for large wealth managers outline which questions are critical in light of the substantial regulatory requirements.

3 Min ReadCustomers in the challenger bank's pilot program drew down an average of $200 each in advance of the government's $1,200 payments.