- 4 Min Read

Many banks are offering low-interest loans to help consumers and small businesses withstand the economic shocks of the pandemic. Some are also doing away with ATM, overdraft and late fees because, as one CEO put it, that revenue “is not the most important thing right now.”

4 Min ReadBanks and credit unions should make it their top priority to pair with the central bank in distributing financial relief to small businesses, even if that means putting everything else on hold.

6 Min ReadAs companies move work off-site because of the pandemic, a host of issues have arisen around remote access, network monitoring and cybersecurity.

1 Min ReadThe regulation issued late on Tuesday directs state-regulated financial institutions to give mortgage borrowers at least 90 days of forbearance if they can show financial hardship resulting from the coronavirus pandemic. It also requires banks and credit unions to provide relief on ATM fees and credit card late payment fees.

1 Min ReadThe central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

4 Min ReadThe COVID-19 crisis is forcing many banks to hold their spring shareholder meetings online only.

3 Min ReadThe coronavirus is changing how consumers interact in branches and banking online. Bank leaders should be prepared.

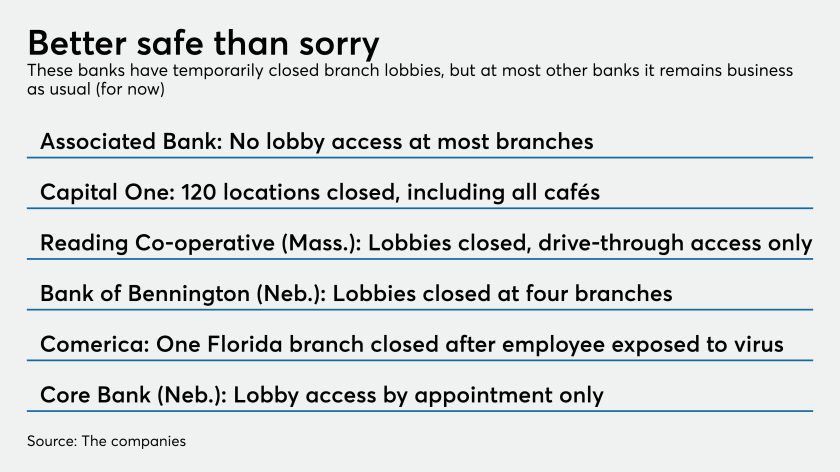

4 Min ReadInstitutions across the country are restricting entrance to their facilities to help curb the spread of COVID-19 but profitability issues could crop up if the pandemic drags on.

4 Min ReadOnline platforms and apps can be utilized to quickly support small businesses and consumers facing unexpected financial hardship.

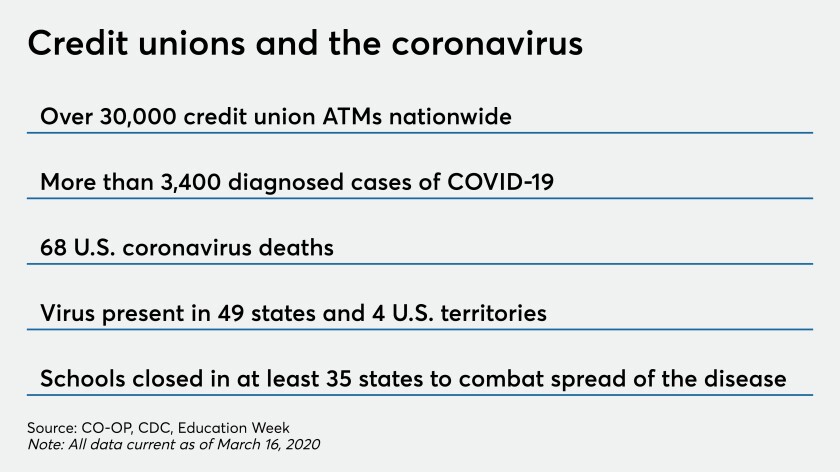

5 Min ReadAs more states close schools and issue shelter-in-place directives, credit unions are increasingly shifting their staff to work-from-home arrangements.

2 Min ReadCustomers are increasingly concerned about taking a financial hit from the COVID-19 crisis and want to know more about fee waivers, credit-line increases and other things banks could do for them.

4 Min ReadAutomated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

2 Min ReadFirst Horizon, Pacific Premier and South State are warning in regulatory filings that the pandemic could complicate deals that have not been completed.

5 Min ReadMany institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

5 Min ReadLenders are rallying around a bill from Sen. Rubio that would give them access to another $50 billion under the 7(a) program. It could face obstacles in the House, where a bill favors direct lending by the Small Business Administration.

3 Min ReadCoronavirus concerns, along with the Fed's emergency rate cut and an erratic stock market, have forced most bankers to take pause and reassess potential deals.

5 Min ReadNo-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

4 Min ReadAs the pandemic spreads, credit unions must take steps to make branches safer for members and staff. Here's how.

6 Min ReadNoah Wilcox, a fourth-generation banker, says community banks are well positioned to provide stability and capital in underserved markets during uncertain times.

3 Min ReadThe outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.