CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

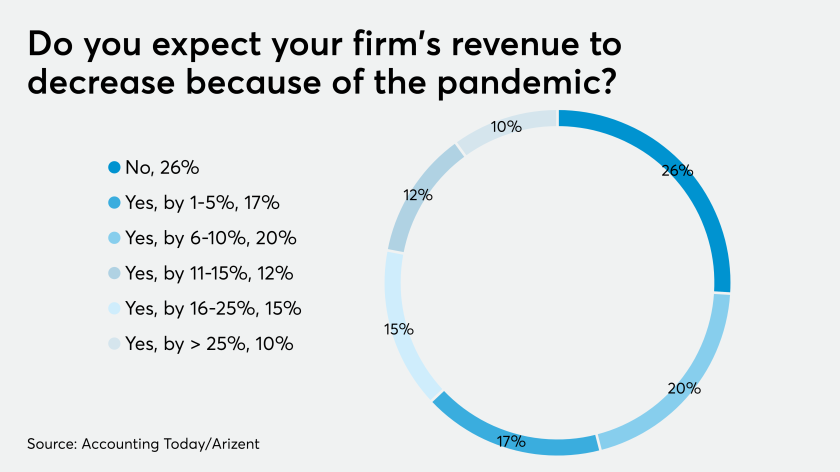

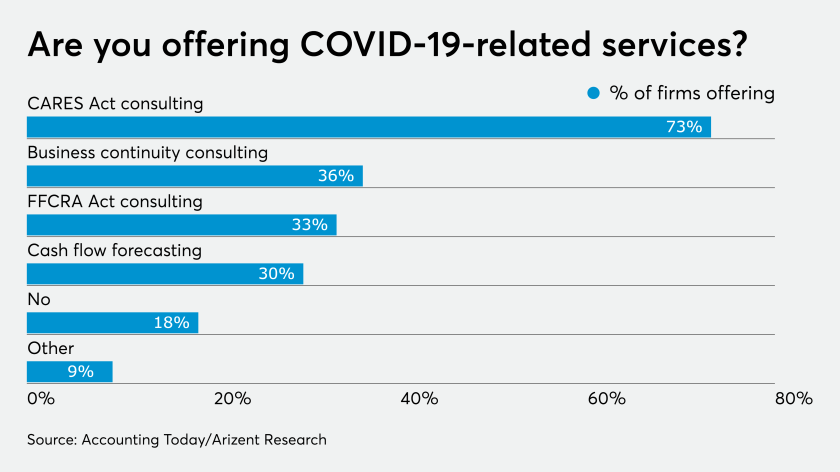

As an accounting professional, these are tough days. But that doesn’t mean your practice can’t grow during this season.

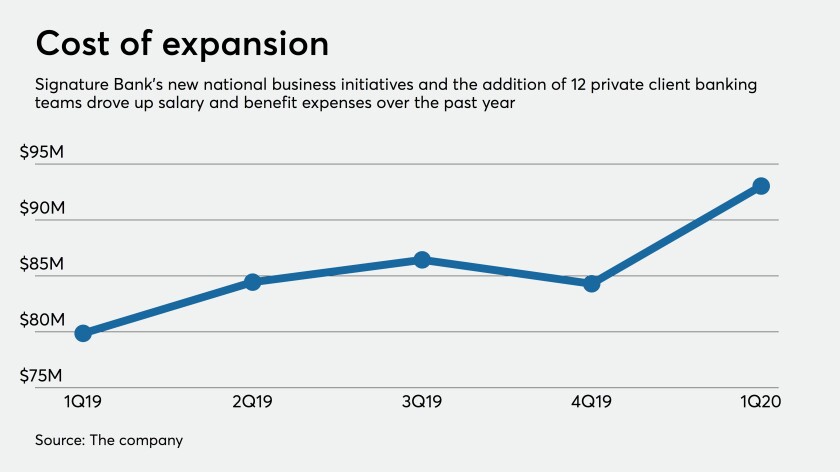

The New York commercial bank says geographic diversification is a long-term necessity and that the interplay of its private banking and commercial banking businesses has helped it withstand the economic shock of the coronavirus.

Wealth management firms should define success by how well their operations perform under pressure, Kestra Financial COO Kris Chester says in an episode of Financial Planning’s podcast.

Highs, lows, curveballs and surprises are routine for every business, including accounting firms. Pandemics, however, are not routine (thankfully!). This crisis tests and provokes us all to the extreme.

Banks would be wise to dust off their Great Recession playbook and shed nonperforming loans while growing through M&A.

Despite the coronavirus, firms can’t afford to stop looking for prospects

This year all playbooks have to be discarded and a fresh start needs to be developed.

The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

The privately held firm recruited more than 160 reps in the first quarter on the strength of its balance sheet, CEO Amy Webber says.