In a year like no other, employers stepped up to provide employees with much-needed support for child care, mental and physical health and financial wellness.

With a CARES Act fix stalled along with stimulus legislation, the institute is urging CPAs to put pressure on their representatives.

Concerns are increasing over the growing spread of COVID-19 and the preparedness of the incoming administration to deal with vaccine distribution and other critical issues.

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

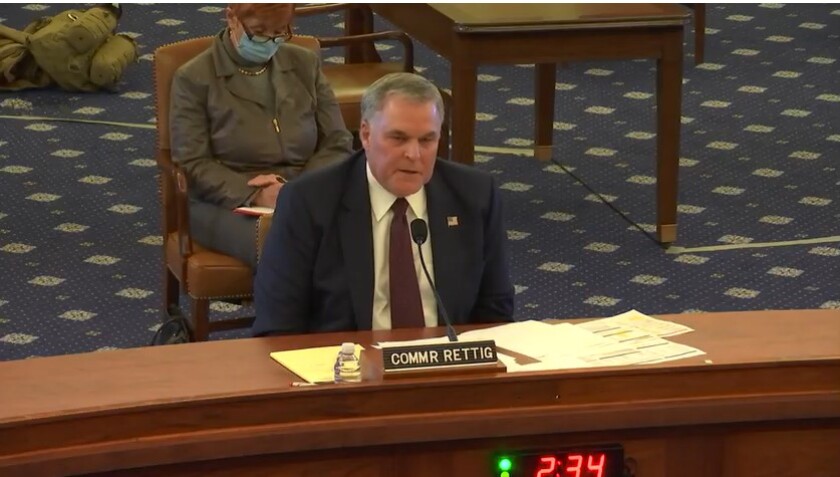

The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

Taxpayers around the world lose at least $427 billion each year to individual tax evasion and multinational corporate profit-shifting, which undercuts public funding for a COVID-19 response, according to a new report.

The top Republican and Democrat on the Senate Finance Committee said the Treasury Department “missed the mark” in new guidance that limits tax breaks for businesses that get their Paycheck Protection Program loans forgiven.

The Internal Revenue Service reminded taxpayers Thursday that they only have until Nov. 21 at 3 p.m. Eastern Time to register for an Economic Impact Payment of $1,200 or more.

The guidance clears up the tax treatment of expenses when a loan from the Paycheck Protection Program hasn’t been forgiven by the end of the year.

From the “Start, stop, continue” method to declining weekly meetings, these tips help employees be more productive and find their purpose at work.