The pandemic is throwing a monkey wrench into plans for the Internal Revenue Service to reorganize itself to provide better taxpayer service.

Nearly one-third of companies are reducing their overall real estate footprint as a result of the COVID-19 pandemic, with 31 percent of companies renegotiating leases for more favorable terms, according to a new report.

Employees working remotely during the coronavirus pandemic claimed some outlandish expenses this year, including pricey exercise bikes, facelifts and private jets.

Between the pandemic, aging CPA firm owners and staffing tensions, many in the accounting profession anticipate a huge uptick in firm mergers and acquisitions over the next 24 months.

The single-family house on Forestview Avenue in Euclid, Ohio, a suburb of Cleveland, shows no signs of farming activity. The only things growing on the one-eighth-acre plot are trees, shrubs and grass.

With remote work and virtual recruiting the new norm, workplace experts weigh in on how employers need to be adapting as they look to rebuild their workplace in 2021.

The institute released the pair of reports as companies increasingly rely on their CFOs and accounting departments to help them survive beyond the coronavirus pandemic.

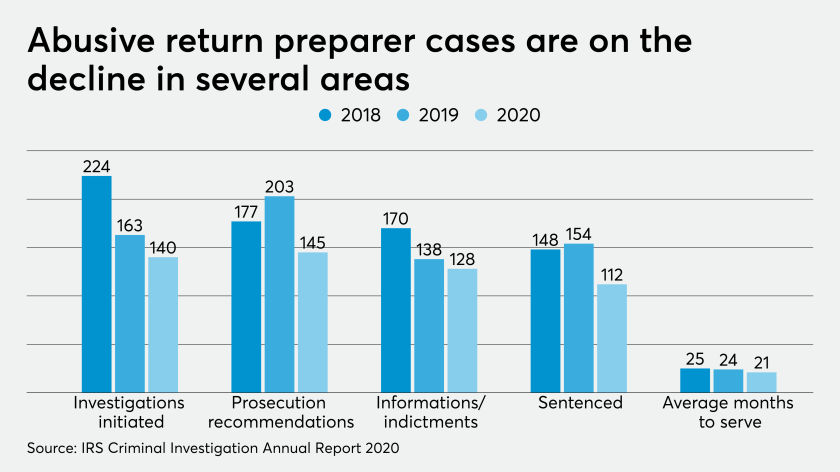

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

Seventy percent of Black Americans do not receive mental health treatment. To combat stressors unique to this workplace population, employers must address discrepancies in their employee benefits.

President Donald Trump spent months on the campaign trail taking credit for “opportunity zones,” a policy meant to encourage investment in distressed communities across the U.S. Joe Biden’s team sees potential in the idea, too.