- 5 Min Read

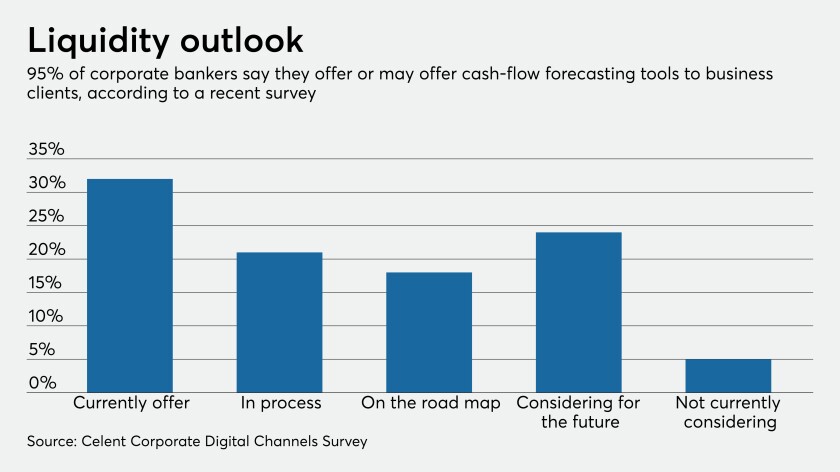

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

4 Min ReadForeign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

7 Min ReadSeveral companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

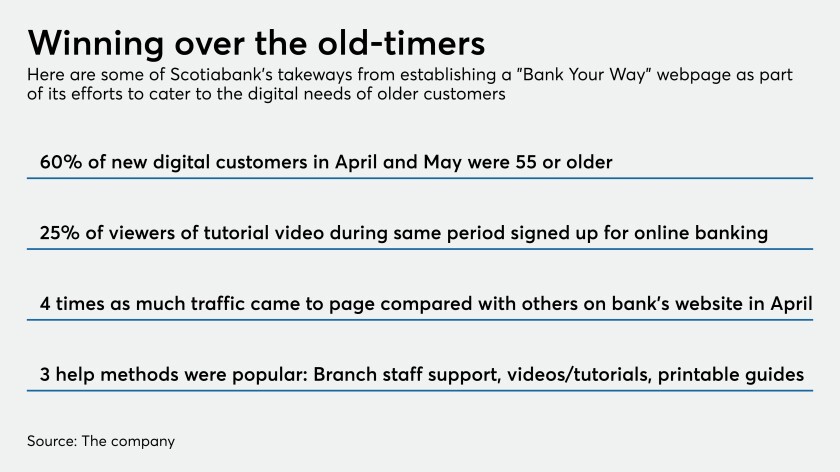

5 Min ReadThe Canadian bank is doing something few U.S. institutions have done: build an online hub with tutorials designed expressly to simplify the online banking process for newcomers.

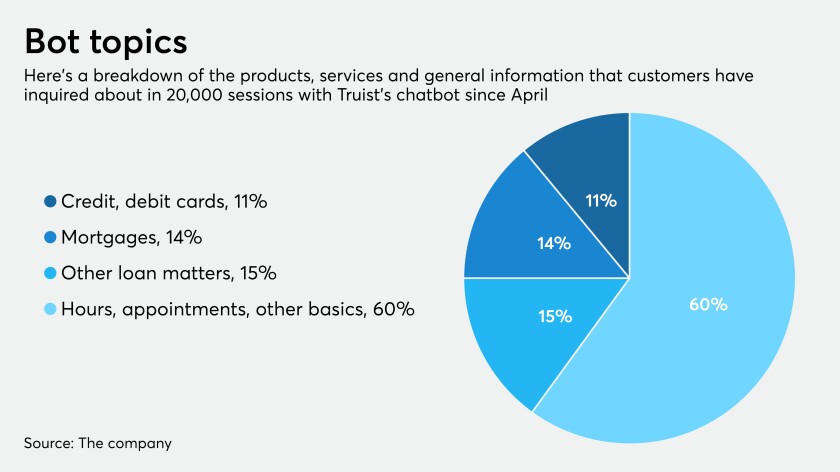

4 Min ReadBuilt to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

3 Min ReadAs more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

6 Min ReadThe digital bank, founded by a former Western Union president, offers tools to help low- and moderate-income people access their wages early, pay bills and engage in other financial services activities for a monthly fee.

3 Min ReadThe coronavirus pandemic has forced some branches to close, but demand for in-person advice remains strong.

7 Min ReadKeyBank, Regions and others are using self-service portals, robotic processing automation and virtual assistants to digitize the collections process and make it more humane in anticipation of rising delinquencies.

3 Min ReadThe pressure is on the fintech, which helps banks make digital loans, to stanch its losses and show its lofty market valuation was deserved.

9 Min ReadCurrent, Stoovo and other companies are reaching out with low-cost, low-fee financial services and even tools to help users search for part-time jobs.

6 Min ReadBusiness models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

2 Min ReadConsumers now have more control over their own financial decisions and loan options.

5 Min ReadIn a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

3 Min ReadThe online lender quickly built an app for ride-share drivers with much of their information already filled in.

8 Min ReadPeoples Bank in Arkansas and Main Street Bank in Massachusetts are getting smarter about spotting suspicious transactions tied to unemployment benefit fraud as well as warning customers what to watch out for.

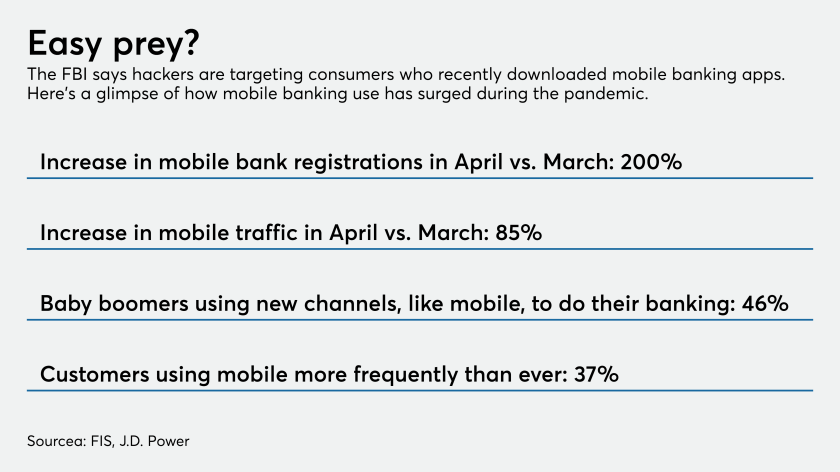

5 Min ReadMobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

6 Min ReadAfter initially processing the loans manually, the Minnesota bank turned to "low code" software to build the electronic forms and workflows needed to approve loan applications. The result: a more than fivefold increase in the number of loans it could process in a day.

3 Min ReadDigital banking has ramped up during the coronavirus lockdown but customers will seek somewhere to go as cities reopen. A branch could provide that safe haven.

5 Min ReadCustomers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.